FCC notably increased its net profit to 139 million euros in the first quarter of the year

- Turnover stood at 1,516.8 million euros, 2.1% more than in 2020

- Ebitdap increased to 254.5 million euros, representing a growth of 16.5%

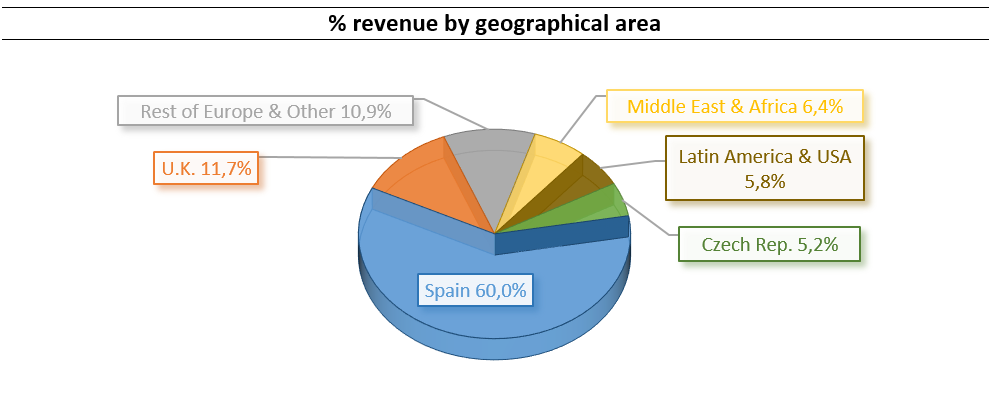

FCC closed the first quarter of the year with a turnover of 1,516.8 million euros, this is 2.1% higher than that obtained in the same period of 2020. This development is a result of the effect of the measures implemented in March 2020, still in force, for the fight against the pandemic, which had a different effect depending on the business area. All in all, there was remarkable improvement in those business areas that were least affected by the mobility reduction measures adopted, especially those referred to as essential services.

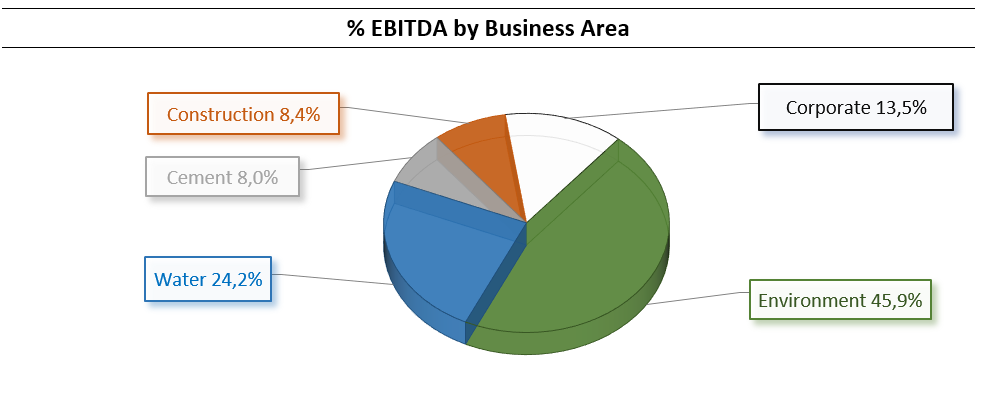

This positive development, together with the continuous monitoring of costs and expenses, is represented in the gross operating result (Ebitda), which improved significantly in the first quarter compared to the previous year, with a registered increase of 16.5%, to reach 254.5 million euros. This positive result is mainly explained by the improvement in the operating margin achieved in the Group's business areas, to which should be added the provision of 20 million euros included in the same period for the previous year as prevention and to combat the negative effects of the pandemic and which was later reversed. Adjusted for this effect, Ebitda for the year increased by 6.7% compared to March 2020.

FCC made an attributable net profit of 139 million euros, which represents a substantial increase compared to the 28.1 million euros for the first quarter of 2020. This positive impact reflects the behaviour of developments in the exchange rate recorded, as well as the closing of the sale of a number of transport infrastructure concessions agreed during the last business year.

The net financial debt, as at 31 March it amounted to 2,613.7 million euros, which represents 6.6% less than in the first quarter of 2020.

Equity totalled 3,061.4 million euros at the end of the first quarter, following a notable increase in net income.

The Group's business portfolio stood at 29,857.5 million euros at the end of last March, with an increase of 1.5% compared to the same period in 2020, due to the incorporation of new contracts in the Environment area, especially in its business in the USA.

Milestones

FCC Environment grows its revenue backlog

In March, the Governing Board of the Council of Tenerife passed a resolution to award the contract for the management of the island’s waste to the joint venture, of which FCC Medio Ambiente is a member at 30%. The contract is worth 397 million euros and comes with a term of 15 years, extendable for a further four years. This represents a backlog of more than 100 million euros attributable to FCC Medio Ambiente. Elsewhere, the final award of the contract for cleaning and waste collection services in various districts of the city of Barcelona remained pending at the end of the quarter. The contract envisions various highly innovative services, including a new electric waste collection truck developed in-house. All in all, the contracts effectively secured allowed to close the first quarter with a revenue backlog of 9,598.5 million euros, up 4.5% on the end of the last business year.

FCC Aqualia wins a new contract in Saudi Arabia and moves past 600 million euros in the Arabian Peninsula

FCC Aqualia, through its Saudi subsidiary company Haaisco, has been awarded the contract for the operation and maintenance of the desalination and drinking water distribution plant in the industrial area of Jizan (Jizan City for Primary and Downstream Industries), in the southwest corner of Saudi Arabia. The client is the company responsible for the supply of water and electricity in the Saudi regions of Jubail and Yanbu, whose majority shareholders are the Saudi State and Saudi Aramco.

As a result, the total value of the contracts currently managed by the integrated water cycle subsidiary in the Arabian Peninsula (Saudi Arabia, UAE, Qatar and Oman) now exceeds 600 million euros. Most of the arrangements relate to concessions and respond to the need to establish public-private partnership models. FCC Aqualia has therefore managed to increase its penetration in the region, with more than six million inhabitants now within the scope of the service.

FCC Medio Ambiente unveils its new 2050 Sustainability Strategy

In the first quarter of the year, FCC Medio Ambiente presented the core lines of its sustainability (ESG) strategy through to 2050.

Its sustainability strategy envisages the fulfilment of all 17 of the Sustainable Development Goals (SDGs) enshrined in the UN’s 2030 Agenda. Along these lines, FCC Medio Ambiente is committed to reducing GHG emissions by 35% by 2030 compared to 2017, and to achieving carbon neutrality by 2050. It also plans to work alongside its clients towards achieving the EU targets for 2035 in relation to waste management, by meeting a target of ≥ 65% of waste recovered and ≤ 10% of waste dumped in landfills.

FCC completes the sale of certain infrastructure concessions and strengthens its financial structure

Last October, FCC agreed to sell its entire stake in three infrastructure concessions located in Spain, as part of its policy on asset rotation and selective development of projects in this segment. The agreement was signed in March, signifying the transfer of the 51% stake held in the Cedinsa road group and the 49% stake held in the Ceal 9 suburban line. The reduction in the associated debt, together with the proceeds obtained from the sale and the Group's performance in general, led to a substantial reduction in financial debt, which stood at 2,613.7 million euros at the close of the first quarter, down 6.6% on the close of the previous business year and further strengthening the FCC Group's financial structure.

FCC Construcción wins the European PPP “Deal of the Year” award for the A465 project in Wales

The project consists of widening a total length of 17.3 kilometres along the A465 main road, which currently has a single carriageway with heavy traffic. The PFI organisation recognised the magnitude and importance of the project to be undertaken as it is needed to improve mobility and connectivity in Wales and also to reactivate the local economy.

| KEY FIGURES | |||

|---|---|---|---|

| (Millions of Euros) | Mar 21 | Mar 20 | Chg. (%) |

| Net turnover (NT) | 1,516.8 | 1,485.4 | 2.1% |

| Gross Operating Profit (EBITDA) | 254.5 | 218.5 | 16.5% |

| EBITDA margin | 16.8% | 14.7% | 2.1 p.p. |

| Net Operating Profit (EBIT) | 158.2 | 94.5 | 67.4% |

| EBIT margin | 10.4% | 6.4% | 4.1 p.p. |

| Income attributable to equity holders of the parent company | 139.0 | 28.1 | N/A |

| (Millions of Euros) | Mar 21 | Dec 20 | Chg. (%) |

| Equity | 3,061.4 | 2,908.7 | 5.2% |

| Net financial debt | 2,613.7 | 2,797.8 | -6.6% |

| Backlog | 29,857.5 | 29,411.7 | 1.5% |